Tax News No 15 – October 2023

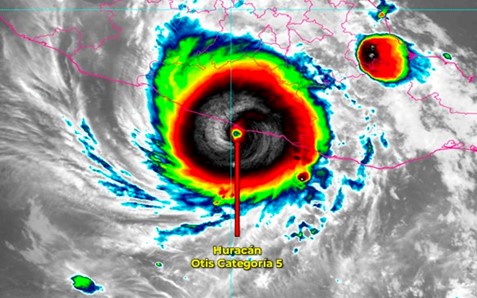

On October 30, 2023, the “Decree that grants various tax benefits to taxpayers in the affected areas indicated by severe rains and strong winds during October 24” was published in the Official Gazette of the Federation (DOF). October 2023” through which incentives are granted to taxpayers residing in areas affected by the passage of Hurricane Otis, under the provisions of article 39 of the Federal Tax Code and whose validity will be from the day after its publication in the DOF.

Se considera que los contribuyentes tienen su domicilio fiscal, sucursal, agencia o cualquier otro establecimiento en las zonas afectadas a que se refiere este artículo cuando hayan presentado el aviso respectivo ante el Registro Federal de Contribuyentes con anterioridad al 24 de octubre de 2023.

The aforementioned fiscal stimuli are aimed at promoting that taxpayers residing in the affected areas have liquidity to meet their economic commitments, granting them, among others, the following facilities:

a) Exemption from the obligation to make provisional payments of the ISR for the months of October, November and December 2023, as well as for the fourth quarter and third quarter of 2023, to taxpayers of the Simplified Trust Regime.

b) Deferral in the obligation to present the returns corresponding to the fifth and sixth two months of the fiscal year 2023 for those taxpayers who continue to pay taxes in the Tax Incorporation Regime.

c) Integer in partial amounts of the ISR withheld for salaries and wages, as well as the VAT and IEPS corresponding to the months of October, November and December 2023.

d) Authorize the immediate deduction and up to 100% of the value of investments in new and used fixed assets that are made in the affected areas in the period from October to December 2023.

e) Allow taxpayers who are exclusively dedicated to agricultural, livestock, fishing or forestry activities to submit monthly VAT returns corresponding to the second half of 2023.

f) Refund the VAT of those requests that are submitted no later than December 2023, in the middle of the period indicated in article 22 of the Federal Tax Code.

Likewise, in order not to reduce financial support, individual taxpayers who pay taxes in accordance with Title IV of the Income Tax Law “On Physical Persons” may not accumulate income linked to financial support from legal entities or entities. trusts authorized to receive deductible donations in terms of the Income Tax Law.

The aforementioned partial payments must be made during the months of January, February and March 2024, without updates, surcharges or fines having to be paid for these purposes.

For its part, the obligation related to deferred declarations in the Tax Incorporation Regime must be submitted no later than February 2024.

Finally, for the purposes of this Decree, the municipalities of the State of Guerrero that are indicated in the Declaration of Natural Disaster that is issued for this purpose by the competent authority are considered “affected areas.”

* * * *

Mexico City

October 2023