Below, you’ll find information about economic estimates for the year 2024, along with changes in the minimum wage effective from January 1, 2024, and the interest retention rate paid by the financial system. These details may be useful for your daily activities throughout 2024, subject to possible modifications during the fiscal year.

- Growth, inflation, interest rate, and exchange rate

On September 8, 2023, the Federal Executive submitted its proposal for the Economic Package for the fiscal year 2024 to the Federal Congress. This package includes, among other things, the General Economic Policy Guidelines for the Income Tax Law initiative and the Federal Expenditure Budget project for the fiscal year 2024.

The Federal Executive’s proposal included the following economic policy criteria:

– For the year 2024, a growth range for the Mexican economy is estimated between 2.5 to 3.5% annually.

– It is projected that the interest rate will close at 9.5% in 2024.

– Inflation is estimated to end the year 2024 at 3.8%.

– Regarding the exchange rate, it is estimated to be 17.6 pesos per dollar at the end of 2024.

The link to access these criteria is: http://gaceta.diputados.gob.mx/PDF/65/2023/sep/20230908-C.pdf

- Interest retention rate paid by the financial system

On November 13, 2023, the Decree was published in the Official Gazette of the Federation, issuing the Federal Income Law for the Fiscal Year 2024. It states that during the fiscal year 2024, the annual retention rate for interest paid by the financial system will be 0.50%.

The link to access this Decree is: https://dof.gob.mx/nota_detalle.php?codigo=5708368&fecha=13/11/2023#gsc.tab=0

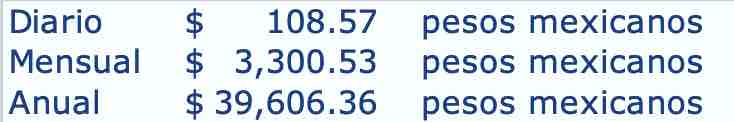

On December 12, 2023, the Official Gazette of the Federation published the Resolution of the Honorable Council of Representatives of the National Minimum Wage Commission, establishing the general and professional minimum wages effective from January 1, 2024.

It specifies that the general minimum wages valid from January 1, 2024, will increase by 20.0% both in the Free Zone of the Northern Border (ZLFN) and the rest of the country. In the Free Zone of the Northern Border, the minimum wage increases from 312.41 to 374.89 pesos daily, while for the rest of the country, the general minimum wage increases from 207.44 to 248.93 pesos daily.

The link to access this Resolution is: https://dof.gob.mx/nota_detalle.php?codigo=5711066&fecha=12/12/2023#gsc.tab=0

We remain at your disposal for any questions or clarifications regarding this publication.

* * * *

January 2024

Mexico City, Mexico